If you make a lump sum overpayment, we may recalculate your contractual monthly payment to reflect the reduced balance. When you use this service, you’ll see all the information you need, including your remaining annual allowance if you have a fixed interest rate.

#Calculator paying extra on mortgage manual#

Underneath the sub menu 'My payments' choose the 'make a payment (Overpayment, missed mortgage payment or manual mortgage payment)' option and select 'lump sum overpayment'. Just select 'My payments and services' from the main menu.

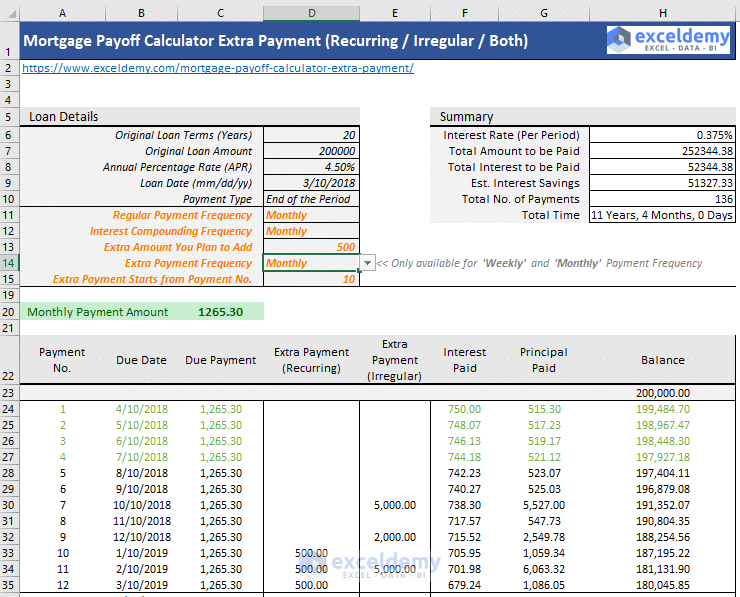

You can use our overpayment calculator found in our online service portal Manage Your Mortgage, to help you work out how much you can save. There are two ways to make an overpayment to your mortgage, either by making a lump sum payment or by making regular extra monthly overpayments.Your home or property may be repossessed if you do not keep up repayments on your mortgage. Please request a Mortgage Illustration before you choose a mortgage. This overpayment calculator does not include all of the information that you need to select or compare mortgages. Please note the calculator does not factor in any charges for early repayments of the total mortgage balance and is based on a capital repayment mortgage. It does not provide a precise calculation of the time or interest you could save, but is intended to give you information and guidance about the potential savings. The calculator is for illustrative purposes only. The figure is rounded up or down accordingly for display purposes. The potential reduction in time to repay your mortgage is presented as years/months.Repayment amounts are rounded up or down accordingly to the nearest £1 for display purposes.Months are of 12 equal lengths so the monthly interest will not differ.The interest rate will remain the same for the term of the mortgage.Monthly overpayments are made and remain constant throughout the mortgage term.The amount you currently pay is based on either your previous monthly payment or the information you have entered.

To illustrate savings, we have made the following assumptions: For more information please refer to your most recent mortgage offer. If you are not on our Standard Variable Rate (which has no restrictions on the amount you can overpay), there may be a maximum value amount you can overpay each year without incurring an Early Repayment Charge.

0 kommentar(er)

0 kommentar(er)